|

To follow our recent analysis of the number of transactions in flight running the considerable risk of not reaching a completion by 31st March 2020, therefore missing out on up to £15K of Stamp duty savings, we have looked more closely at the stage of these transactions.

We are uniquely placed across the whole UK residential property market to be able to view these transactions, grouped against key milestones in the journey to a completion, through the power of our insight from our sister company View My Chain.

Getting these transactions progressed passed the searches ordered stage is the greatest predictor of a successful and more timely transaction our analysis has confirmed since the inception of our View My Chain platform.

As we enter the second national lockdown it will be interesting to monitor whether there are further impediments to getting these vital transactions for the UK economy through in a timely manner.

|

|

|

|

The headlines

|

|

|

|

•

|

Over 515k properties are currently in the progression pipeline between having a sale agreed and completion.

- This is 44% higher than in November 2019 (359k properties).

|

|

•

|

These 515k properties account for £181 billion of equity.

- Which requires more working capital.

- And equates to £1.8 billion of Estate Agent commissions.

|

|

|

|

|

Recently, we have spoken about how the residential property sector is being overwhelmed by increased demand fuelled by the first lockdown and the stamp duty holiday.

We fear that 325,000 buyers might miss out on the benefits of the stamp duty holiday because their property purchase will complete too late because of the unusually high demand. Further that the time it takes to progress a sale (i.e. the lag from agreeing a sale on a property to completing the purchase of one) is an average of well over 5 months.

Today, we combine TwentyCi’s powerful data resources with our sister company (View My Chain) to give you a comprehensive view of how many properties are currently having their sales progressed and where they are in the system.

|

|

The Property Progression Pipeline.

|

|

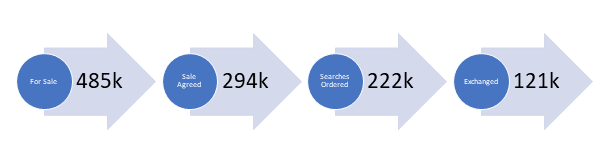

The pipeline of property stock currently in various levels of the system is as specified in the graphic below…

|

|

|

|

There are currently 294k properties that have had a sale agreed, but not yet ordered legal searches and a further 222k properties that have had a sale agreed and have ordered legal searches.

Totalling these two together shows that there are over 515k properties currently in the progression pipeline between having a sale agreed and completion.

To establish whether or not this is high or low, we have to look at comparisons:

- This time last year, there was 359k properties progressing, so today we are 44% greater than last November.

- The average for the whole of 2019 was a very similar number to November 2019 at 353k, so today we are 46% greater than the average of 2019.

- At the height of lockdown #1 (at the beginning of May), there were only 256k of properties in the progressing stage, so today is greater than lockdown #1 by 102%.

The message should be clear - there are significantly more properties in a sales progression state today than at any time since our records began in 2008.

|

|

The Risks

|

|

Why is this an issue?

The longer progression times become, the more chain breaks occur, the more sales agreed fall through. We have reported this in recent client briefings suggesting that a 30% increase in fallen throughs wipes over £4 billion from the UK Gross Domestic Product (GDP).

It is perhaps a good idea to reference some further financial analysis at this stage. Starting with collective property value terms, the 515k of progressing property stock accounts for £181 billion of equity. Whilst we know that not every property purchase is financed by a mortgage and that loan to value (LTV) percentages are lower on average than they were, this is a significant amount of working capital tied up for lenders (post agreeing a mortgage application in each case).

Next comes the Estate Agent sector that is generally paid on completion. If we assume that on average commission values are 1% of transaction prices, this £181 billion of equity equates to £1.8 billion of Estate Agency commission fees placed at risk.

In short, the risks to the sector and the wider economy are substantial.

|

|

Required Action

|

|

Our view remains that the government has an opportunity to get ahead of this impending issue and review the stamp duty holiday. This could be achieved either by announcing an extension or amending the 31st March end date to taper off beneficiaries to avoid the “cliff edge” of 325,000 people who risk missing out. This in turn will avoid a massive increase in transactions falling through.

We will, as always be keeping an eye on this situation as it develops over time.

|